Tough times create unexpected expenses, and a car title loan is one of the most straightforward solutions, especially if you have a bad credit history and can’t increase your credit limit or get a personal loan. Most people realize that a title loan isn’t a good idea only when they want to get out of it. But don’t worry – it happens to the best of us.

Discipline and dedication can help you if you’re stuck in a title loan. Let’s get into it and find the best solution for you.

Understanding the challenges of title loans

Title loans are no joke – while almost anyone can get them, title loans can even worsen your financial situation due to ridiculous conditions and interest rates. Title loan companies take your car as collateral, so you may lose your vehicle if you default on the loan. Moreover, many of these companies aren’t playing around when a customer can’t keep up with payments because repossessing a vehicle is easier for them than extending the loan or changing the conditions.

A title loan should be your last resort. If you get one, you should focus on getting out of it as soon as possible.

Used cars have dark secrets

Reveal them all! Just enter a VIN code and click the button:

Strategies for getting out of a title loan

A title loan can empty your pockets. You’ll probably have to tighten your belt to get out of it, but there are a few solutions that should ease the process.

Pay back within the first day

Some title loan companies allow paying back the loan without interest within 24 hours after taking it. For instance, if you need money quickly and you can repay the loan the following day, you may be able to get out of it without paying any interest. However, you won’t avoid origination, processing, and other fees that most companies charge.

Evaluate your financial situation

Your loan is likely older than one day, so you need another option to solve the problem. Car title loans often come with an APR of 300%, which can be overwhelming. You may need to think creatively to find ways to repay it. Here are a few solutions if you don’t have the money on hand:

- Negotiate for better terms. Some title loan companies are willing to negotiate or roll over your loan, especially if you’re struggling with payments.

- Borrow money from friends or relatives. It’s usually better to owe to close ones than a title loan company because of huge interest rates and the risk of losing your car.

- Ask for a salary advance from your employer. Your employer may pay your complete or partial salary in advance if you ask for it.

- Sell something. You can’t sell your car if its title has a lien, but you may find some items you don’t need, such as tools, an additional set of tires, clothes, and electronics.

The earlier you pay off a title loan, the more money you save on interest, so it’s advisable to collect all the money you can find and pay off your title loan earlier.

Explore refinancing options

If your credit score is good, you can refinance your title loan with better terms and a lower interest rate. According to Bankrate, the average personal loan interest rate is 12.21% – 25 times lower than a title loan. More favorable terms can help you cope with the loan more easily, but title loans are chosen mostly by those with poor credit scores, so this may not be an option for you.

Another option may be a title loan relief program, which also refinances your current loan, providing you with better conditions, including lower and fixed monthly payments.

Consider debt consolidation

Debt consolidation may be a good option if you’re in a financial pinch because of several loans. Banks, consumer lending companies, and other financial institutions often offer this service. A debt consolidation covers all your debts, converting them into one loan with better conditions and lower interest rates. This can be a great solution since varying conditions and limits put a lot of mental and financial pressure on you.

Contact a financial adviser

There are plenty of financial experts who help people struggling with debts and other economic challenges. They can help you discover the solutions you may haven’t thought of. Since most of their customers have a limited budget, they often allow paying for their service in small monthly payments. In fact, you can always contact a financial adviser before making serious financial conclusions to avoid mistakes.

How to get your car title after loan payoff

Paying off a car title loan feels wonderful, but the last payment doesn’t automatically solve everything. You still may need to take a few steps to ensure the title belongs to you and is lien-free.

Title-holding states vs non-title-holding states

How and when you can get your title back depends on whether you’re in a title-holding or a non-title-holding state.

In title-holding states, the lienholder is the primary owner of the vehicle, while the borrower’s name is mentioned separately. As a result, a lienholder can keep the title until the vehicle is paid off. After paying off the loan, the lienholder usually sends the title to the borrower.

Meanwhile, in non-title-holding states, the process is vice versa – a borrower is the primary owner of the vehicle, while the lienholder is mentioned separately. Borrowers are allowed to keep the title throughout the loan, and they receive an official release of lien letter when the loan is paid off.

ELT systems

Electronic Lien and Title (ELT) systems are becoming increasingly popular in various states. They make title processing much easier and safer, taking most of the stress off your shoulders. When you pay off a title loan, an ELT system usually releases liens and transfers the title automatically, so you don’t have to do anything.

However, if your state still uses paper titles, you must undergo a specific process. Contact your local DMV to learn more about title requirements and procedures.

General process

While the specific process of getting your car title varies by state, the general approach usually is as follows:

1.Confirm loan repayment. Your lienholder should inform you when the loan is paid off. If not, contact them once the loan is paid off.

2.Request title release. If the lender didn’t send you an official release of the lien after you paid off the loan, ask for it.

3.Provide necessary information. Once you get a release of lien letter, take your car’s VIN and proof of identification because you’ll have to fill out a form.

4.Inform your insurer. Many insurance companies require their customers to inform them about title changes. This can reduce insurance costs and may be necessary to validate the insurance.

5.Wait for your title. Depending on your state’s processes, your title should be ready in 2-6 weeks.

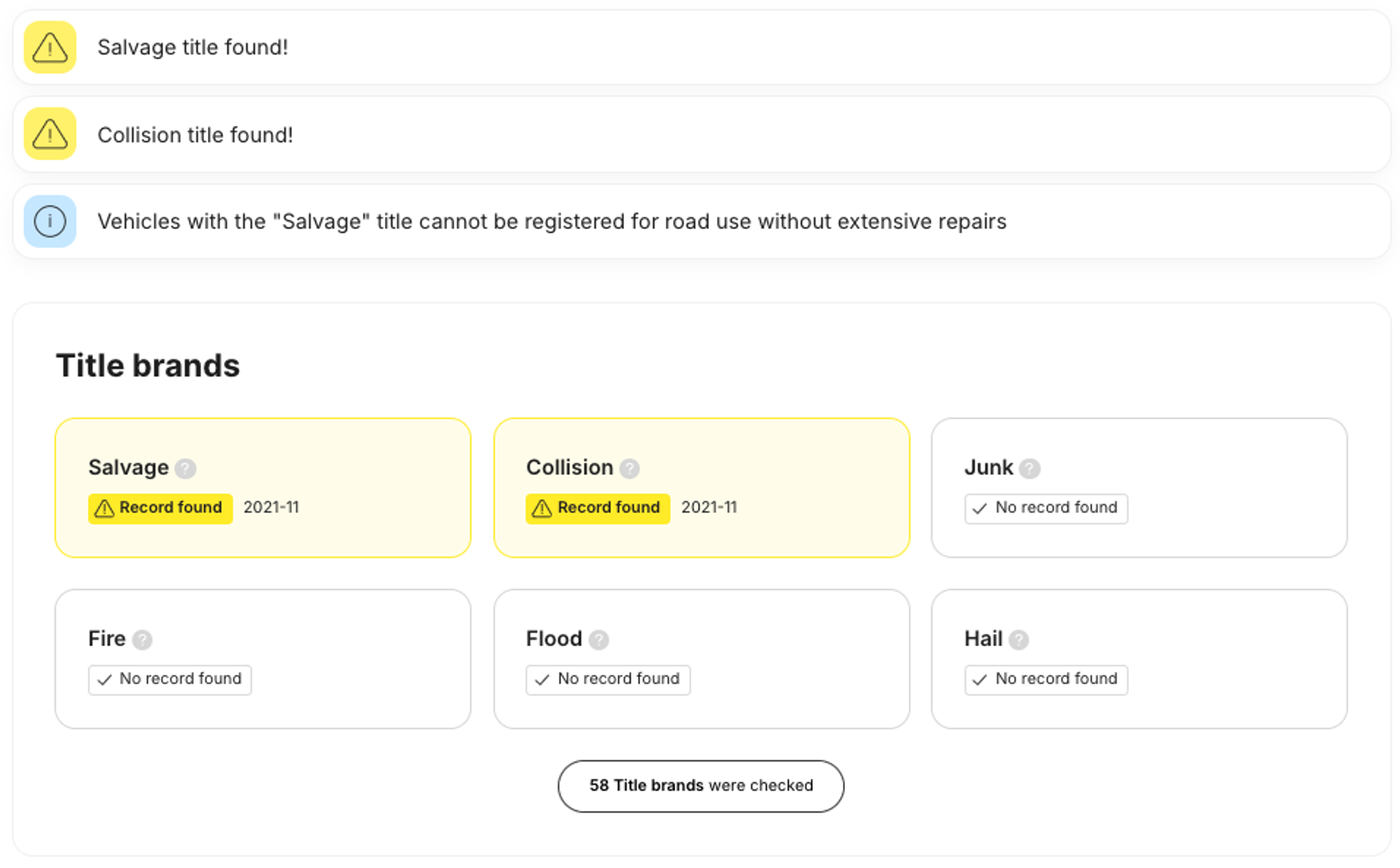

An important thing to note is that you may want to check the vehicle’s history before going to your local DMV. A DMV can add car title brands if they have enough proof of damage or other issues, and a vehicle history report could set clear expectations for you. You can use our VIN decoder to learn about any vehicle’s history, revealing damage, mileage records, title brands, and ownership changes.

Got out of a car title loan – what now?

The worst is behind you, but it doesn’t mean you should rest on your laurels after paying off a car title loan. It’s important to avoid financial risks to avoid similar problems in the future, so a few precautions should help you.

Create a financial plan

Set strict goals and limitations regarding spending and saving money. 36% of Americans have more credit card debt than savings, causing huge financial stress in case of unplanned expenses. Try to cut unnecessary costs and see how much of your monthly income you can put into your savings account. Most banks also offer automatic monthly transfers to savings accounts, making it easier for you.

There are many ways to improve your financial situation, but most importantly, avoid staying where you were financially before taking a car title loan.

Rebuild your credit

A credit score is a number that banks and other institutions use to evaluate a person’s ability to manage their finances. A slight misstep can decimate it, causing difficulties when getting a loan, renting an apartment, or insuring a vehicle.

The credit score system is relatively straightforward – it’s a calculation based on your payment history, debts, credit history, and other financial information. Pay your bills on time, don’t apply for unnecessary credit, and your credit score should increase significantly in a few years.

Build an emergency fund

Many people are counting on loans in case of an emergency, especially when maintaining a good credit score is challenging. A proper emergency fund could at least partially cover unexpected expenses, such as a leaking roof, a broken vehicle, or even the loss of a job. You don’t need to build an emergency fund for years – according to financial advisors, a person should be able to live off his emergency fund for 3-6 months.

Check your registration number

Avoid costly problems by checking a vehicle's history. Get a report instantly!

Remember that car title loans often lead people to more financial problems, so avoid taking title loans unless you desperately need money and can’t get it anywhere else. A well-planned budget and limited spending are crucial to preventing a financial pinch and unnecessary stress.

Frequently asked questions

Article by

Evaldas Zabitis

Evaldas has been writing since middle school and has had a passion for cars for as long as he can remember. Right after getting his driver’s license, he spent all of his savings on shoddy cars so he could spend time fixing, driving, and selling them. Evaldas is always interested in automotive technical innovations and is an active participant in automotive community discussions.