There’s nothing quite like the thrill of getting behind the wheel of a car you’ve been dreaming of for a while. However, purchasing it from a dealership can sometimes seem like navigating a complex maze of options, negotiations, and paperwork that can leave you feeling a mix of excitement and apprehension.

In this guide, we delve into the essential strategies and considerations that will help you make a successful dealership purchase.

Need help buying a used car?

Enter a VIN code to learn more about any vehicle!

3 reasons why you should buy from a dealership (and 1 why you shouldn’t)

Buying a car from a dealership offers several advantages that can make the process more reliable and convenient, especially when buying a used car.

1.Dealerships have a reputation to maintain. As a result, they are interested in doing their research and avoiding bad cars. They have the people and resources to do it, too.

2.Dealerships offer a wide variety of vehicle options and financing options (including trade-ins). This diversity allows buyers to easily compare different options in person, and pay for the one they like.

3.Dealerships provide additional warranty packages and after-sale services. Unlike most private sellers, dealerships often extend their commitment to customers by offering scheduled maintenance, technical assistance, and access to genuine parts. When bundled together, they offer substantial risk mitigation.

The counterpoint to all of this? Buying from a dealership is more expensive. Usually, cars in the dealerships are 10% to 40% more expensive than those sold by private sellers.

5 questions to answer before going to a dealership

Before setting foot in a dealership, it’s imperative to analyze and pinpoint your needs. This includes an exploration of your lifestyle, priorities, and future plans to determine the type of vehicle that will best accommodate your daily routine and long-term goals.

Here are 5 questions that will help you do it.

What activities do I need a car for?

For example, sedans and hatchbacks, renowned for their fuel efficiency and maneuverability, are well-suited for urban commuting and couples without kids. On the other hand, SUVs offer spacious interiors, robust towing capabilities, and off-road prowess, making them ideal for families, outdoor enthusiasts, and individuals seeking a versatile driving experience.

Trucks, known for their hauling capacity and durability, are favored by those in need of towing capabilities and rugged utility for work or fun. Each vehicle type has distinct attributes that cater to a variety of lifestyles and driving preferences.

What is my budget?

Effectively managing your budget is a pivotal step in the car-buying process. Beyond the initial purchase price, it’s essential to factor in additional costs, including insurance, maintenance, fuel expenses, and potential financing payments.

Evaluating your finances will help you figure out the right price range for your future vehicle and ensure you’re not overspending. It will also minimize financial strain down the road.

Petrol, hybrid or electric?

The easiest way to decide what type of powertrain you need is to consider a few key factors:

- Your annual mileage

- Where and under what conditions you will drive the car

- Which you prefer more: fuel economy or performance

In theory, electric vehicles can offer both fuel economy and performance, but the initial investment may be too expensive for some because you do not only need to buy an electric car. You also need to invest in your own charging station (wall box) to reduce the cost of charging in public places.

Hybrids are the best choice for those seeking fuel economy, especially with cars like the Honda Accord or Toyota Prius, because the car's proportions, weight, and other factors help to increase fuel efficiency.

Petrol cars are the more affordable and versatile option today. The wide choice of options does not force you to compromise when choosing a model, body type, or drivetrain. However, in the long term, petrol cars will be more expensive to maintain.

Should I choose a new or used car?

The answer to this question generally is dictated by the amount you have for the car purchase, but as a general rule, you should consider different options.

Dealerships always offer intriguing new car ownership options, which could help you acquire a brand-new car for as little as $300 to $400 a month. Moreover, the warranty will cover any unexpected vehicle breakages, which is a considerable advantage over used car ownership because you must cover every bit of repairs from your pocket.

However, used cars offer considerable advantages, too. Unlike with new cars, with used cars you don't have to worry as much about depreciation because the most significant drop in value occurs during the first few years of ownership.

Moreover, the used car market offers broader possibilities for finding the car you want exactly. Depending on your needs, you can buy a high-tech luxury limousine or bare-bones sedan. Additionally, authorized dealers offer warranty-equipped, pre-certified used vehicles.

What dealership to choose?

In theory, all dealerships operate under the same business model. However, each dealership experience may vary slightly due to differences in car selection, staff service, and the overall quality of service provided.

Before you start planning your journey to the nearest dealership, do your research and find other buyers' reviews and experiences about their visits.

Moreover, sometimes a dealership a little farther away might offer exactly what you want: a warranty, a good price, and a car in good condition.

How to talk to dealers

When talking to dealers, don't forget to communicate your needs, preferences, and budget constraints as specifically as possible. Don't forget to ask: investigate the vehicle's features, performance, and history to understand what you're getting yourself into.

Some tips on how to talk to dealers:

- Show genuine interest. Ask the dealer about their experiences with different cars and ask for recommendations based on your preferences. Demonstrating a genuine interest in their expertise can take you a long way towards getting more attention and a better deal.

- Set a firm budget and stick to it. Before entering the dealership, establish a clear budget that aligns with your financial capabilities. Be assertive in communicating your budgetary constraints so you don't end up overspending and get caught up in the upselling tactics while negotiating with a salesperson.

- Know what you want. Do your research to figure out what features you need in a vehicle. This can shield you from being enticed by unnecessary add-ons, preventing cost inflation.

- Be cautious of bundled packages. Dealers often promote bundled packages that include extra features or services. While these bundles might seem attractive, carefully evaluate whether you really need them.

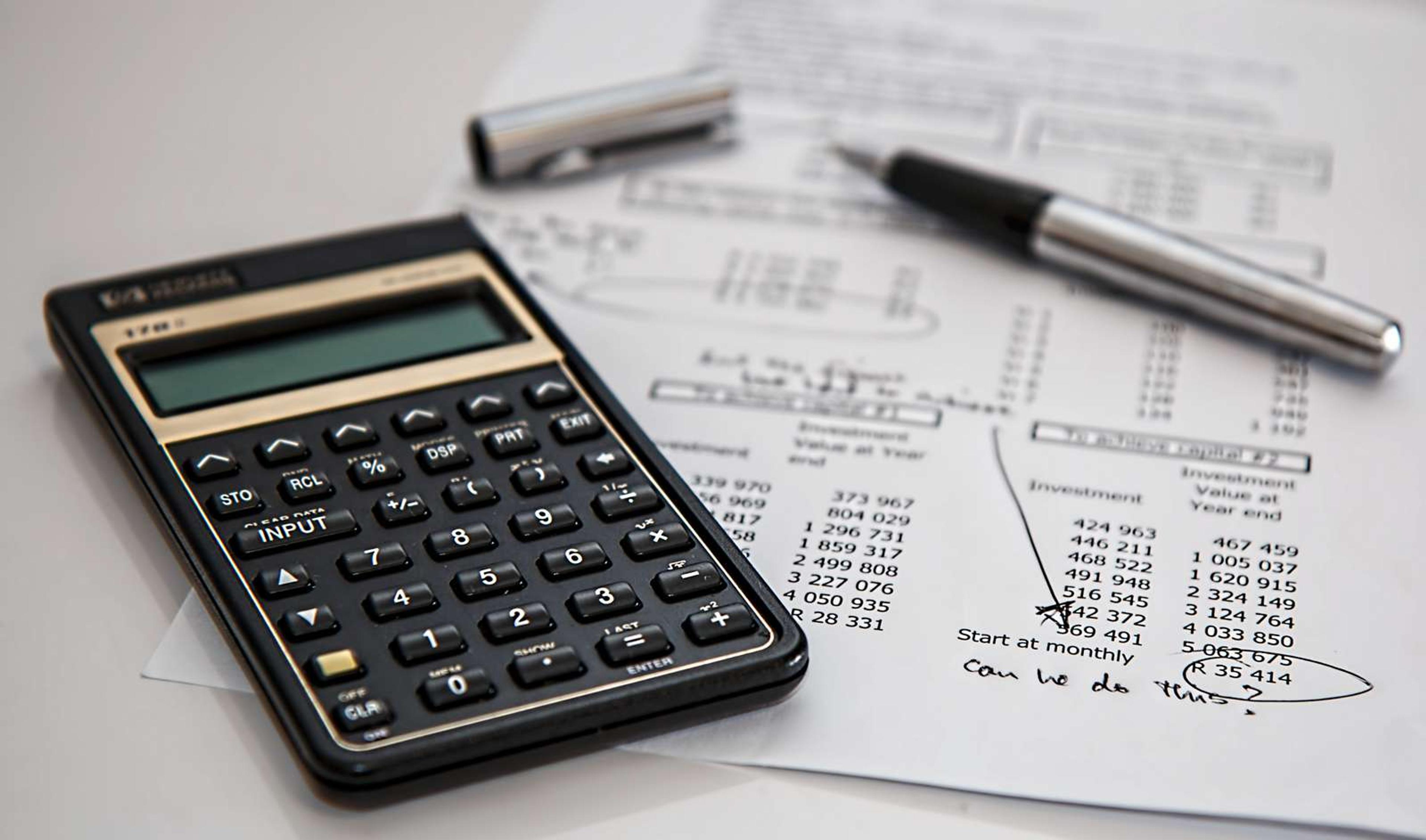

How to finance your purchase

Understanding the ins and outs of financing a car can be challenging. It requires a clear grasp of available choices and their impact on your financial well-being in the long run.

Keep these tips and factors in mind to make the process smoother and more manageable.

Evaluate your financial capabilities

- Interest rates. Compare the offered interest rates from different lenders to secure the best option. Be aware of the impact of even slight variations in interest rates on the overall cost of the loan.

- Down payments. Assess your budget and consider making a substantial down payment to reduce the overall loan amount and lower monthly payments. Aim for a down payment of at least 20% of the car's purchase price to minimize the risk of negative equity and decrease the overall interest paid over the loan term.

Consider different loan types

In theory, both in-house financing and bank loans can help achieve the same goal, but if you look more closely at the details, you will soon notice significant differences:

- In-house financing. The dealership acts as the lender, making the approval process more straightforward. This option is more accessible for individuals with less-than-perfect credit, but the interest rates may be higher, and the terms and conditions may vary significantly.

- Bank loans. Bank loans usually have a rigorous application process, including a thorough review of credit history, financial status, and other factors. However, banks also offer more competitive interest rates, making them more attractive from the financial point of view.

Compare interest rates and loan terms

The final step is to compare the offers from both in-house financing and bank loan. Compare the terms, interest rates, and fees, to get the best financing arrangement possible.

Moreover, evaluate the duration of the loan carefully, taking into account your financial capabilities and long-term goals. While longer loan terms might offer lower monthly payments, they often result in higher overall interest payments, increasing the total cost of the vehicle.

Aim for a loan term that balances manageable monthly payments while minimizing the total interest paid over the loan period.

What are some hidden additional costs

Many consumers believe the advertised price of the car is the final cost. However, there are usually additional costs that can significantly impact your overall budget.

Dealer fees

When discussing terms with the dealer, inquire about specific fees, such as documentation, advertising, or service charges. Additionally, make sure you're careful when reviewing the contract – examine each line item on the list of charges. If you come across any vague or questionable fees, ask for an explanation.

Extended warranties and add-ons

- Make sure you understand the coverage and limitations of any extended warranty or add-on service before committing to the purchase. Thoroughly review the terms and conditions to ensure it offers genuine value.

- Take the time to research the reliability of the vehicle and its components to determine if an extended warranty is truly necessary. For instance, if the car has a history of strong performance and low maintenance issues, you might reconsider the need for additional coverage.

- During the negotiation phase, treat extended warranties and add-ons as separate from the actual car purchase. Be prepared to negotiate the terms and consider seeking multiple quotes to ensure you're getting the best deal possible.

Taxes and registration fees

Familiarize yourself with the specific tax and registration regulations in your state before finalizing the purchase. For instance, in California, the state sales tax rate for vehicle purchases is 7.25%, while registration fees can vary depending on the vehicle's value and weight.

When calculating your budget, remember to include not only the initial taxes and registration fees but also any potential recurring costs. For example, in Texas, annual vehicle registration fees can range from $50.75 to $54, depending on the county of residence and the vehicle type, in addition to a title application fee of $33.

Maintenance and repairs

- While you search for a vehicle, also research the expected maintenance costs over time, including routine services such as oil and tire changes, brake inspections, etc. The average annual maintenance cost for a compact car like a Toyota Corolla is approximately $350, whereas a more upscale vehicle like a BMW 3 Series may cost around $900 per year for routine upkeep.

- Before finalizing the purchase, inquire about the vehicle's repair history and any known recurring issues. For example, certain models may have common issues such as transmission problems or engine malfunctions, which could result in significant repair costs over the vehicle's lifespan.

- Create a budget that accounts for unexpected repairs by setting aside a designated amount each month. For example, if you plan to purchase a used SUV like a Honda CR-V, it's advisable to allocate an additional $50 to $100 per month to cover any unforeseen maintenance or repair expenses that may arise.

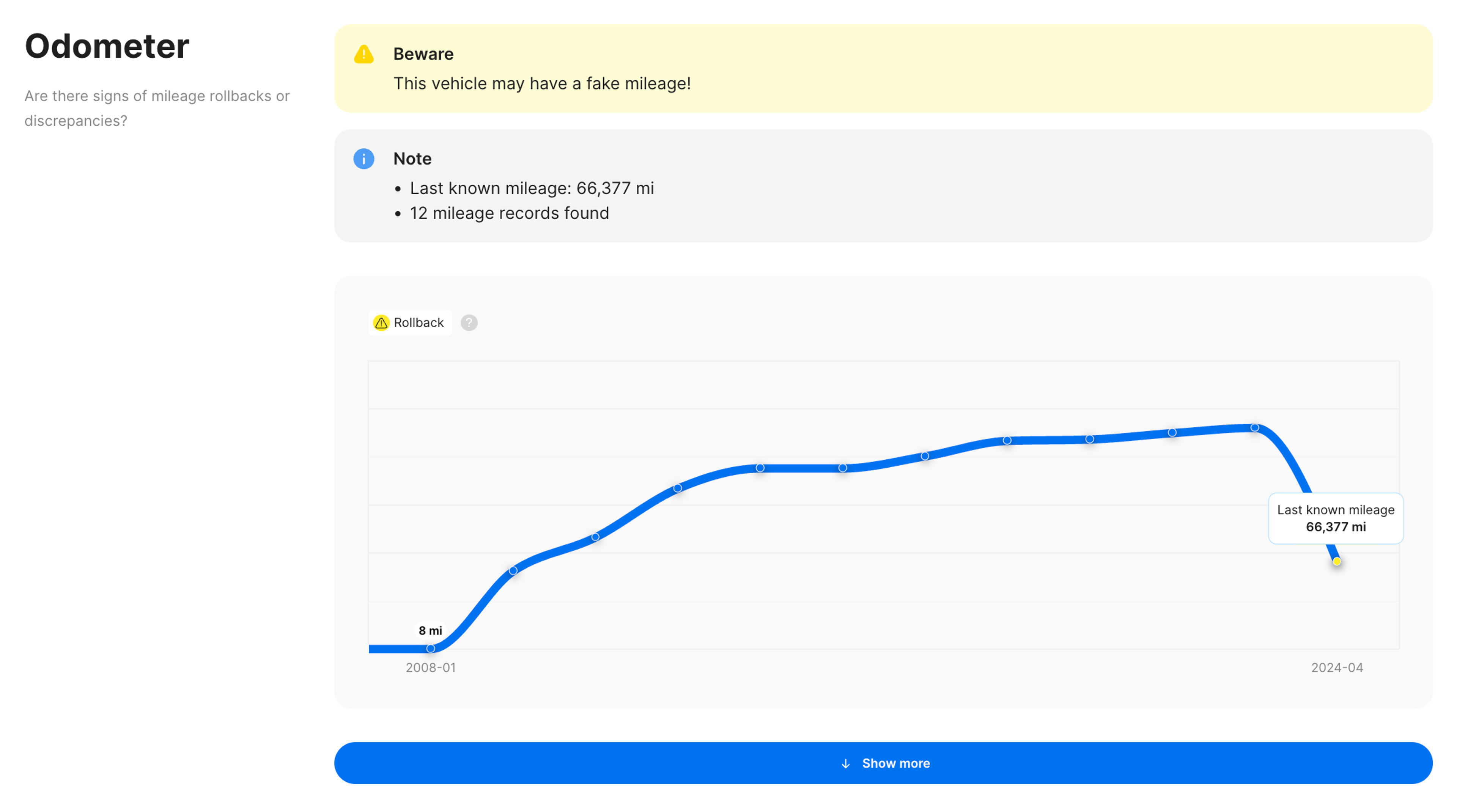

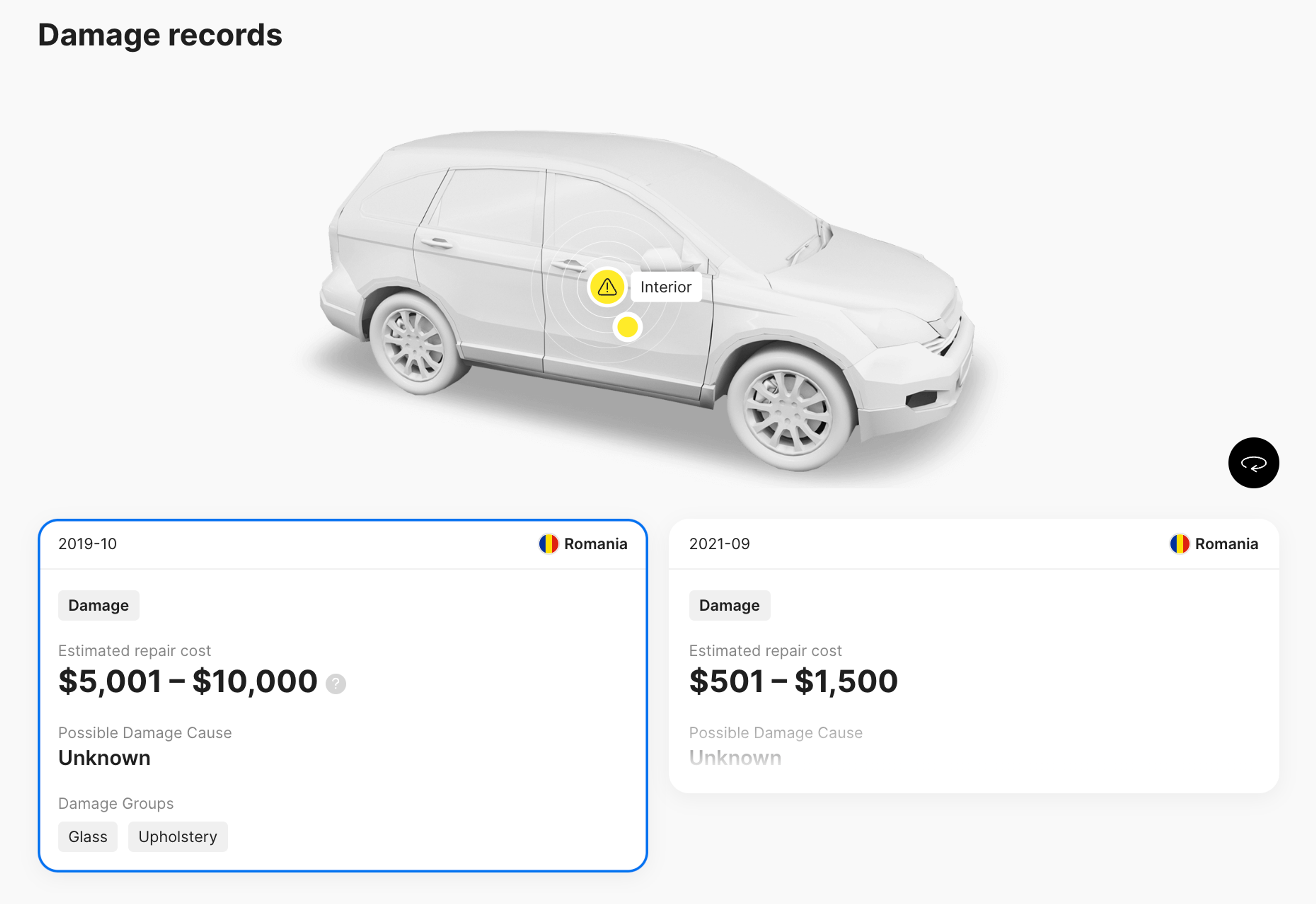

Always get a vehicle history report

A quick look at the car's history can usually tell you more about the vehicle than its lengthy description provided by the seller.

For instance, a car's mileage can be a great indicator of a vehicle's condition – higher mileage generally means more wear and tear on the vehicle's components. Therefore, dishonest sellers try to tamper with it, reducing the displayed mileage to make the car appear less used and more valuable than it actually is.

As for the damage, minor scratches are normal and do not alter the operation of the airbags or the whole car structure, but bigger impacts require knowledge and certain investments to make the car roadworthy again.

Not all sellers fully disclose the car's past. A vehicle history report can show damage records, whether the mileage is accurate, let you check the car's financial and legal status, title information, ownership changes, and more.

Understanding the car's history helps ensure you’re making an informed purchase.

Check your registration number

Avoid costly problems by checking a vehicle's history. Get a report instantly!

Use additional safeguards

Vehicle history reports can be very helpful in conjunction with other measures to ensure that you're buying the right car at the right price.

Increase your chances by buying a car from carVertical partnered dealerships, take a test drive and test the safety features, and inspect a vehicle at an independent workshop, which could assess the car professionally and thoroughly.

Understanding the paperwork

Buying a car is already a huge financial commitment, so reading the sales contract is paramount. The sales contract serves as a legally binding agreement between you and the dealer, outlining the terms and conditions of the transaction.

Reading the contract thoroughly is essential for the following reasons:

- Understanding all terms and conditions. Ensure you understand all the terms in the contract, including the vehicle's final price, financing details, and any additional fees or charges. This helps prevent any misunderstandings or disputes in the future.

- Knowing your responsibilities. The contract outlines your responsibilities and obligations, such as timely payments, maintenance requirements, and warranty terms. Understanding these obligations enables you to fulfill them effectively and avoid any penalties or legal repercussions.

- Addressing issues before signing. Reading the contract allows you to identify any discrepancies between what's agreed and what's on paper. It's crucial to address any issues or negotiate modifications before finalizing the deal.

List of essential documents

Ensuring you have the necessary documents is crucial for a smooth and hassle-free transaction:

- Car title. It serves as legal proof of ownership, ensuring you have the right to possess and use the vehicle. Furthermore, it includes all the necessary information about the car, including the VIN number.

- Bill of sale. Imagine you've purchased a used car and later discovered an undisclosed issue with it. The bill of sale would serve as crucial evidence of the agreed-upon terms, enabling you to seek legal recourse or negotiate a resolution with the seller.

- Odometer disclosure statements. The purpose of this is to prevent odometer fraud by keeping an accurate record of the vehicle’s mileage at the time of sale. However, because state requirements differ, some states exempt cars older than 10 years from odometer disclosure requirements.

- Warranty information. Imagine your newly purchased car experiences a mechanical issue within the warranty period. Having the warranty information at hand would enable you to understand the coverage and seek repairs or replacements from the manufacturer or authorized service centers without incurring additional costs.

- Insurance. Before you drive the car off the lot, dealerships need to see proof of insurance. Talk to an insurance provider and get coverage before you make the purchase.

Know your consumer rights

While most dealerships strive to uphold their reputation, it's essential for you, as a consumer, to understand how state laws protect your rights from fraud or deceptive dealership practices.

- Consumers have the right to accurate and transparent information about the product, including its features, history, and potential defects.

- When negotiating the price of a car, you have the right to request a detailed breakdown of all costs, including taxes, registration fees, and any additional charges.

- If you encounter significant mechanical problems with the car shortly after purchase, you have the right to seek assistance from the dealership or manufacturer for repairs or compensation, as outlined by the warranty or consumer protection laws. In the worst-case scenario, consumers are protected by the so-called lemon law.

How to take the delivery of a car

When the day finally arrives, try to contain your excitement, especially upon seeing the car in front of you. Before you can fully enjoy your new purchase, consider using the tips below.

- Inspect the exterior and interior for any damages and ensure they are documented before accepting the vehicle.

- Verify that all agreed-upon accessories and features are present and in working condition.

- Double-check all the necessary paperwork and vehicle documents, including the vehicle's identification number on the bill of sale, finance, or lease agreement.

- Test drive the car once more to confirm that it meets your expectations and performs as agreed.

Post-purchase tips

Once a car becomes your property, it’s essential to keep up with its maintenance to ensure an enjoyable ownership experience for years to come. Here are some key post-purchase tips to maximize your car’s longevity.

Maintenance and servicing schedules

- Stick to the recommended maintenance schedule outlined in the owner's manual to ensure the timely servicing of essential components, such as the engine, brakes, and tires.

- Regularly check fluid levels, filters, and tire pressure to uphold optimal performance and safety standards.

- Invest in quality parts that will last much longer than those available at the lowest price.

Utilize the dealership's after-sales services

- Seek professional guidance from dealership technicians for any queries or concerns regarding the vehicle's performance.

- Utilize the warranty for any covered repairs or services to reduce out-of-pocket expenses.

- Take advantage of useful discounts offered by the dealership.

Conclusion

Navigating the car-buying process requires careful consideration, effective negotiation, and proactive post-purchase maintenance. By sticking to the insights provided in this guide, every step of the buying and owning a car will be as seamless as it sounds.

Just remember to prioritize your individual needs, familiarize yourself with consumer rights, and leverage the available resources to make well-informed decisions. Additionally, always check car history to ensure that it doesn’t have any hidden issues.

Article by

Aivaras Grigelevičius

Aivaras has been excited about cars since he was a little kid. Later, this passion for drivable objects (and everything that surrounds them) grew into work as an automotive journalist. Since then, Aivaras has written for several different magazines, covering anything with an accelerator pedal. He has a soft spot for cars with an Alfa Romeo badge.