The second-hand vehicle market has heated up even more due to the recent semiconductor supply crisis. But while pre-owned cars may be a cheaper option, many drivers risk buying more – or less – than they’ve bargained for.

Dishonest sellers often try to pass you a car with all sorts of undeclared problems under the hood, such as clocked mileage or structural damage suffered in an accident. In some cases, you can even end up buying a car that is under finance or has been straight-up stolen.

Fortunately, there are a number of ways buyers can avoid scams altogether. And even if you do get screwed, not all is lost. We’ve asked experts in the field to offer tips on what to look out for, and what to do when you end up buying a car with problems you didn’t expect.

Need help buying a used car?

Enter a VIN code to learn more about any vehicle!

Should UK buyers worry about getting scammed by used car salesmen?

Although used vehicles are often cheaper than brand new models, unfortunately not everything is straightforward and buyers should keep their eyes out for potential scammers.

According to Action Fraud, the UK’s national reporting centre for fraud and cybercrime, 9,484 reports on scams were submitted to the agency under the Online Shopping and Auction Fraud category in 2021 alone. The losses of buyers amounted to £22.5 million for that period.

There are many ways crooks on UK used car markets try to screw money out of unwitting buyers:

- Selling cars with structural damage (some even written off by an insurance company due to the cost of repairs outweighing the value of the car)

- Tampering with odometers to roll back the mileage

- Selling vehicles with a finance agreement against it

- Sellilng stolen cars with replaced number plates

Buying from a dealership is always a safer, albeit more expensive bet.

Your mileage may vary

Odometer fraud, also referred to as “clocking” in the UK, is a practice of rolling back odometers so the vehicle appears to have less mileage than it actually does. In older cars, odometers are rolled back by reversing the numbers on the mechanical instrument that records the distance traveled by the vehicle. Odometers in more recent car models are mainly digital, but those too can be reset using electronic tools.

A 30,000-mile car can bring twice more money than one with 90,000 miles on the clock due to expected wear and tear.

It is not surprising that crooks are willing to tamper with odometers. In Britain, while selling a car without disclosing known mileage discrepancies is currently illegal, the actual act of altering the readings is not. The Local Government Association (LGA), which represents councils in England and Wales, has called for a ban on “mileage correction” tools that could be acquired online for as little as £100. Few believe this will significantly impact the issue.

Another reason to roll back the odometer before the MOT check is the insurance premium. “You will pay a higher insurance premium if you do more miles in the car”, explains James Martin, known on YouTube as JayEmm, “mileage clocking has been observed in all parts of the industry, including luxury cars and especially lorries.”

Research suggests that there could be as many as 2.5 million clocked cars on UK roads costing drivers over £800 million a year.

Many UK buyers are not aware of mileage fraud as there are no obvious signs of tampering with the odometer to the untrained eye. But the financial burden of such alterations on consumers is staggering. Buyers not only pay inflated prices for clocked vehicles but also suffer additional maintenance and repair costs and greater depreciation.

Registering a car in the UK is easy for better – and worse

“It’s dead easy to register a car in the UK when it changes hands,” says automotive journalist Mat Watson. “The seller fills in the V5C registered keeper document with the new keeper’s name and address and sends it off to the DVLA to register the transfer. The new keeper then gets a new V5C document through the post with their name as the registered keeper.”

In comparison, the process of registering a car in Germany is a lot more stringent. All vehicles must be registered with the relevant authority in the area where the car’s owner lives. This applies even if you move to a different city within Germany. If you acquired your car through a dealership, the company usually handles the registration. But if you bought the car privately or have imported it, you will need to do it yourself by making an appointment at the local car registration office, where you will have to present a stack of documents, including a valid ID, registration certificate, proof of ownership, proof of car insurance, certificate of conformity, proof of roadworthiness, and so on.

Lax vehicle registration rules in Britain may feel like a boon for customers, but is it always for the better? “Note the term registered keeper,” warns Watson. “This means you are responsible for the car in terms of tax, insurance and fines. But it is not a sign of ownership.”

“The registration document (the V5) does not prove that you own a car, but people tend to think that it is”, Martin agrees. Thus, you can end up buying a car that actually belongs to a finance company until any debt is repaid, for example.

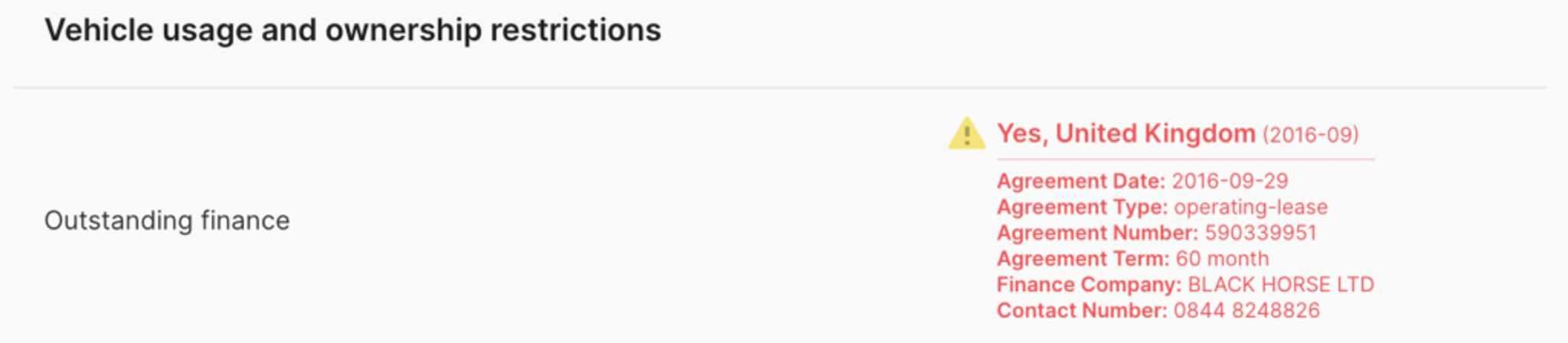

New car finance deals are so widespread that almost 90% of private new vehicles are bought under some form of finance. Selling a car with outstanding financing violates the Hire Purchase and Personal Contract Purchase agreements as you don’t technically own the vehicle. But that doesn’t stop some people from selling such vehicles.

Some criminals engage in this type of fraud at scale. They contact sellers of cars with outstanding finance agreements and offer the seller to pay off the balance, only to end up promptly selling the vehicle to auctioneers or unsuspecting dealers.

Lookalike cars

Martin also points out that “there’s been a problem in the UK with number plate cloning, which is basically taking number plates from a different car and selling it.” Thus, the deal fetches a far better price than it's worth.

Crooks do this to sell cars that have outstanding fines, vehicles written off by insurance companies, and even non-existent cars sold via online platforms.

British portal Confused.com looked into the frequency of car thefts in 35 European countries from 2011 to 2019, and Britain, with an average of 153 cars stolen per 100,000 inhabitants each year, can’t boast in this regard.

If you are unlucky to acquire a stolen vehicle, you stand to lose both the car and the money you paid, so it’s an absolute must to run a history check on any car you intend to buy.

Not all stolen cars are a no go. Police or insurance companies sometimes sell off cars that were stolen and later found. “I have once looked into what they call a stolen recovered car,” says Martin. “Sometimes this puts people off, of course. But such cars could be a good bargain – if you are willing to overlook the distasteful past."

Beneath the paint: Damage to the car may be greater than it seems

Watson remembers buying a Porsche 996 and even paying a Porsche specialist to do a physical inspection before making the deal. “They failed to notice numerous issues which subsequently came to light,” Watson says, “such as the whole driver’s side having had a respray and the colour not quite matching. There was filler over the rear driver’s side, probably from the same incident. The ‘inspector’ also failed to spot that the synchromesh on the second gear was failing – something that was repaired under warranty. And thankfully, there was no key structural damage to the car. I got £500 back for the poor inspection after pursuing them through Visa, which was used to make the payment.”

With nearly 40 million vehicles on UK roads, accidents happen every day. Insurance companies operating under stringent algorithms always scrutinise damage done to crashed vehicles and calculate the costs of repairs.

Insurance write-offs occur when a vehicle suffers too much damage to be deemed road-safe. Some vehicles are also written off when they are still safe to drive, but the cost of repairs exceeds the value of the car itself. This sometimes leads to situations when a car, having only sustained seemingly minor cosmetic damage, is still categorised as a “write-off”. This is why different categories of write-offs apply, helping buyers decide if they can still sell or buy a used car that has been in an accident.

There are currently four categories of car insurance write-offs to rank the severity of the damage:

- A – cars that should be scrapped and never returned to the road (even salvageable parts should be destroyed

- B – cars that should be scrapped and never returned to the road (some parts can be salvaged)

- S (formerly C) – cars that have suffered structural damage and are unsafe to drive before professional repairs

- N (formerly D) – cosmetic damage, problems with electrical circuits, the braking or steering system, etc.

Some written-off cars appear on the second-hand market. “Some of them have been written off because they were considered old and worthless at the time and given away for scrap without real damage done to them, but then gained the status of a classic,” James Martin says. “But there are also cases when you buy a category N car and then realise there are way more serious problems underneath.”

Some sellers may try to hide the past of Category S or Category N vehicles and pass them off as non-damaged, as this puts some customers off and depreciates the car.

Buyers may also be daunted by the related potential insurance costs. “A car that has been written off and subsequently repaired and put back on the road may be more expensive to insure,” Mat Watson says. Some providers even refuse to cover written off cars at all.

How to protect yourself from scams

“I've always done history checks on any used cars I've bought,” Mat Watson says. Car history checks usually reveal if the odometer of a vehicle has been tampered with. Free or cheap online car history checks are often not as comprehensive as those offered by more serious companies.

“Mileage clocking can also be avoided by buying cars that have a really good service history,” Martin says. If you check the paperwork, such as workshop invoices and the service book, you can spot discrepancies between mileage and oil change frequency.

A history check is also the best way to find out if a car has outstanding finance. If there is actually such an agreement against the vehicle, don’t buy it and walk away. If you know the car has outstanding financing and decide to go ahead with the transaction, you’re just as guilty as the seller.

A history check is also the best way to find out if a car was damaged, and it usually reveals all road accidents and damage done to the car, especially if it has been written off by an insurance company. Unless of course, the accident hadn’t been reported to the authorities at all, which sometimes happens.

Check your VIN

Avoid costly problems by checking a vehicle's history. Get a report instantly!

If you are worried that the used car you are interested in could have been cloned, make sure the car’s number plate matches the 17-digit VIN number and the registration number on the V5C logbook. “The registration document should always come with the car,” James Martin warns. “If the car does not have a V5, you should know that something is not right.”

“There is always a greater risk when buying from a private seller than a business or registered trader. You have no consumer protection when buying from a private seller,” Watson warns. “When buying privately, always do a history check and make sure you see the car at the address of the registered keeper on the V5C. When buying from a dealer, pay for at least part of it on a credit card as then you have extended consumer rights. Only ever buy privately if you can see the car at the registered address on the V5C.”

You got scammed – what now?

In case you failed to do the proper homework or were tricked by a cunning scammer, not all is lost. There are a number of ways to get out of the unpleasant situation.

“Know your rights,” James Martin says. “You can get repairs done or even return a car if you have bought it from a dealer and it’s not to your satisfaction.”

The Consumer Rights Act allows you to return the car or have it fixed if you believe that its quality is not satisfactory; it does not match the description given to the buyer before the purchase, or it is not safe to go on the road.

If you unwittingly bought a clocked car, you shouldn’t sell it on, as this would be considered an offence. You should instead contact a local trading standards office and ask them for advice. Dealerships should normally refund the purchase under the Consumer Rights Act. But if you took it off the hands of a private seller, the situation is muddier. In such cases, much of the responsibility falls on the buyer. The only obligation the private seller has is to truthfully answer your questions about the car. They won’t be responsible for not disclosing any issues you failed to inquire about. Enforcing your rights in such cases can be a challenge.

You are more likely to be refunded if you can prove the transaction to the relevant authorities with paperwork and traceable payment methods. “Always pay for stuff on a credit card as you have better consumer rights,” Mat Watson advises.

If you happen to find out that the vehicle you bought is stolen you should immediately contact the police, turn the car in and initiate a process of getting a refund from the seller, be it a dealership or a private person.

If you are unfortunate enough to buy a stolen car without knowing it, you’ll probably find out soon enough, as stolen vehicles are flagged as such in databases of the police and insurers. Regardless of the outcome of the investigation, the vehicle will be confiscated and returned to its rightful owner or the insurance company.

Article by

Tadas Švenčionis

Tadas is the Editor in Chief of the carVertical Blog. A fan of all things automotive and tech, he makes a point of making complex topics simple and engaging – after all, what good is a story no one understands? Tadas spends his free days reading, gaming, and bringing music no one’s asked for to Vilnius, Lithuania.