Used car dealerships are at the heart of the second-hand market, and therefore some of carVertical’s most important clients.

Throughout February and March, we ran a survey to better understand how European dealerships function:

- What cars they buy and sell

- How they manage risk

- What their relationship with import/export is

- How they stay informed about the industry

We received answers from 3 big used car markets in Europe: Italy (63 dealerships), France (61 dealerships), and Poland (54 dealerships). Here’s what we’ve learned.

Key takeaways

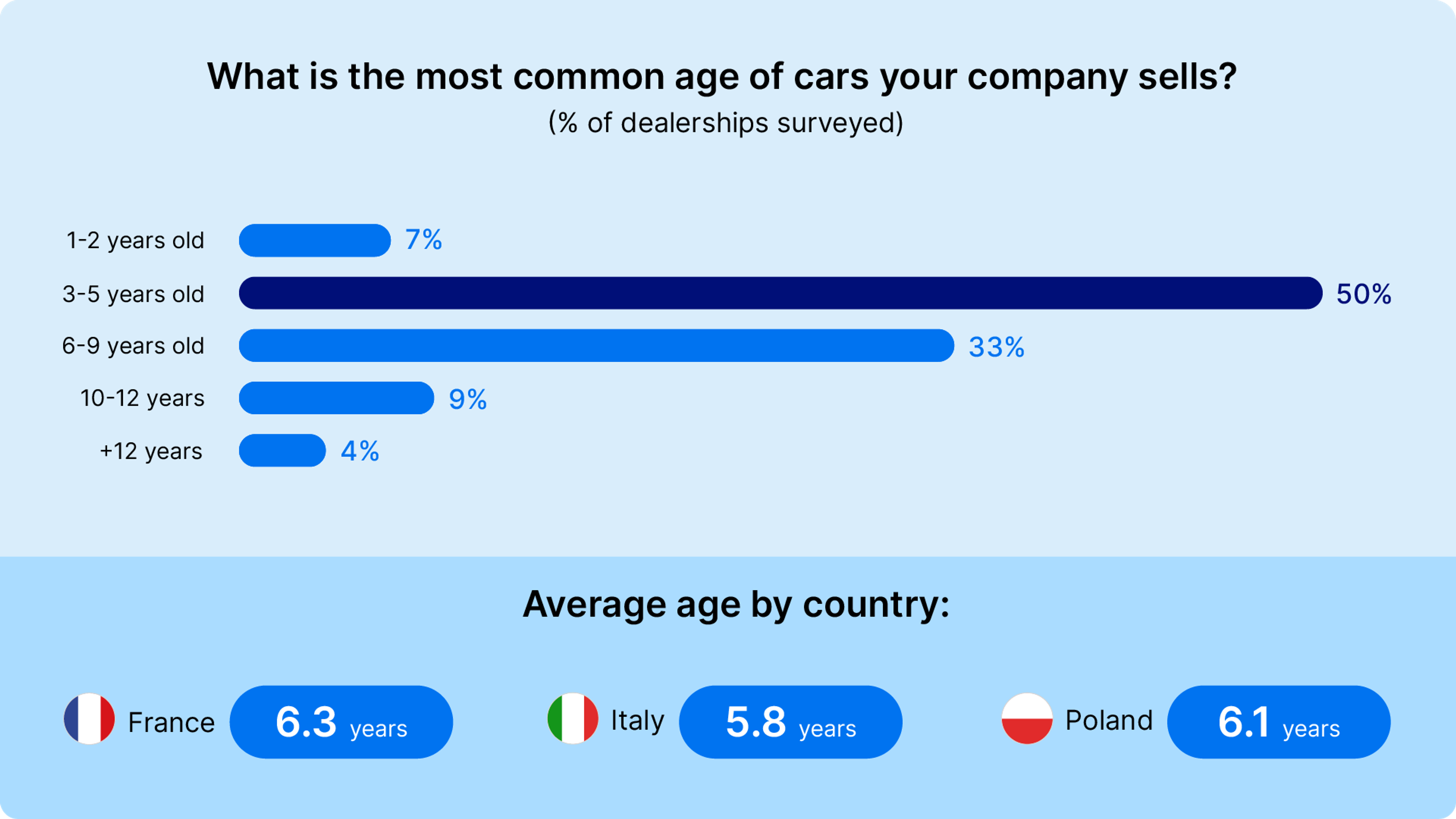

- Most cars sold are 3-5 years old (50%) or 6-9 years old (33%)

- More than half of the cars are in the 10,000-20,000 EUR range

- French buyers favor more expensive vehicles (30,000 EUR average) than Poles (21,300 EUR) and Italians (17,400 EUR)

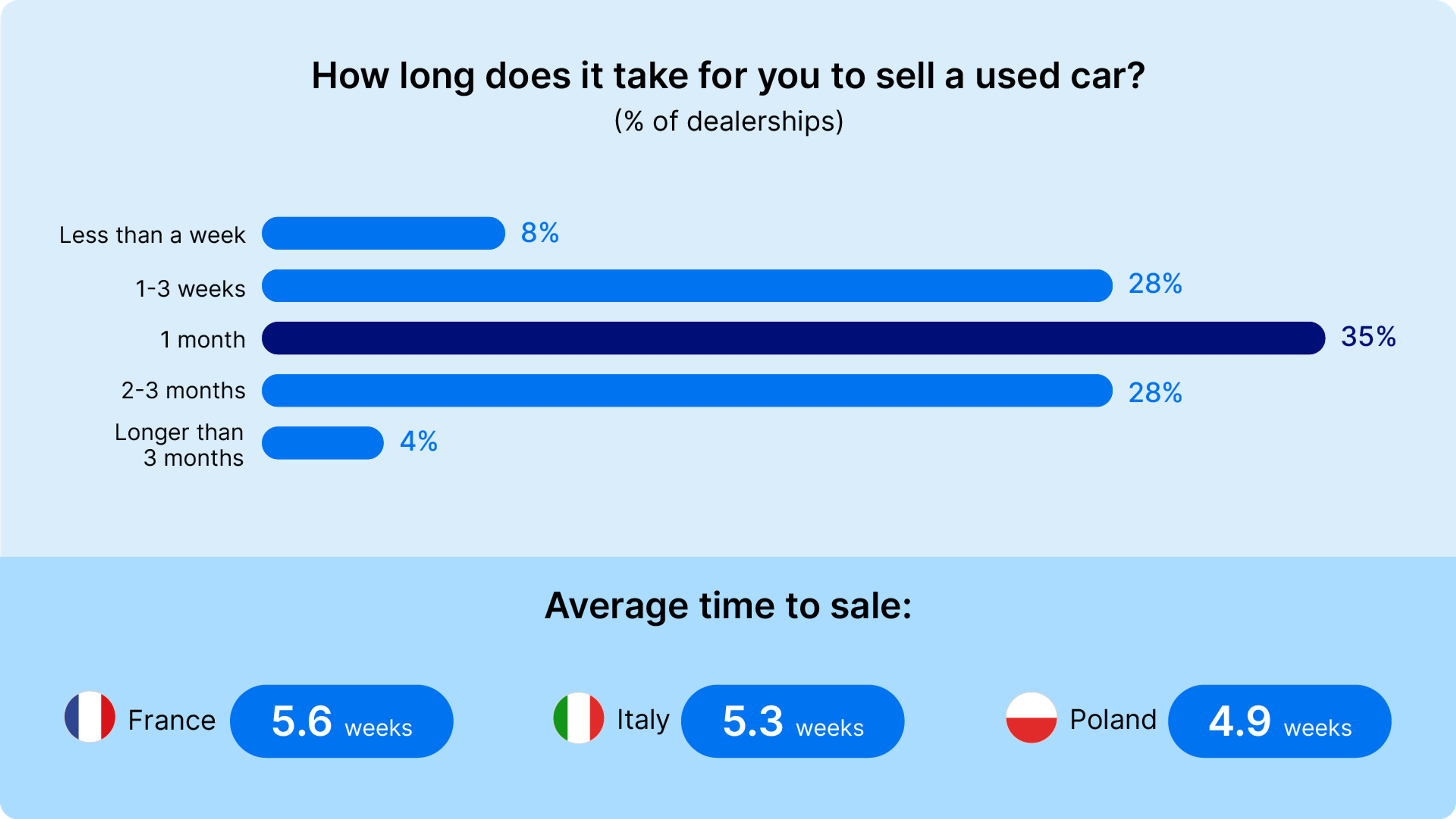

- Most cars (91%) sold within 3 months: 1 month (35%), 2-3 months (28%), or 1-3 weeks (28%)

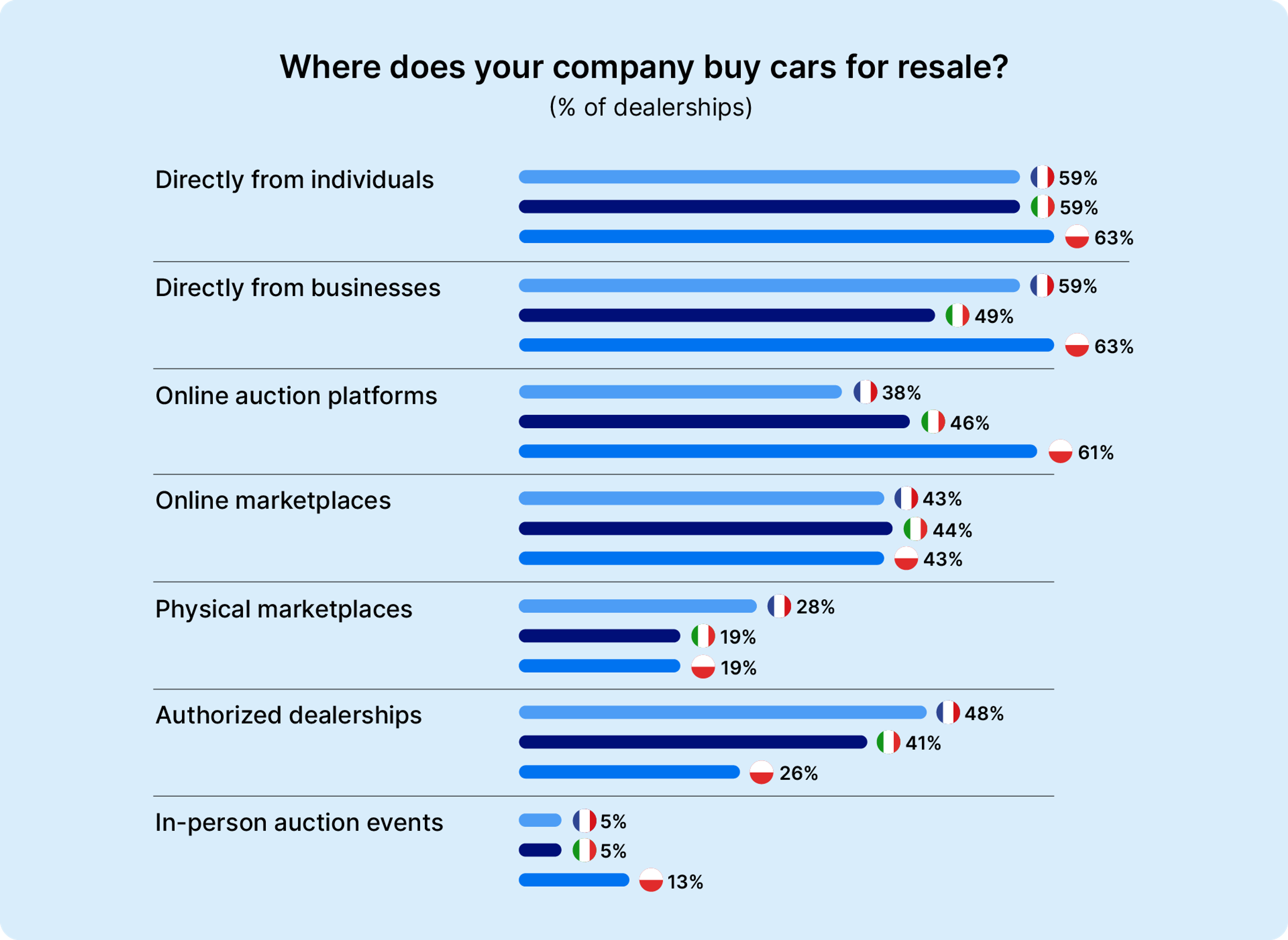

- Direct purchases from individuals and businesses is the most common source of cars

- 48% of French dealerships favor buying from other authorized dealerships.

- 61% of Polish dealerships buy from online auctions (46% in Italy)

- Online marketplaces are the 3rd most common source of cars for dealerships in France, Italy, and Poland.

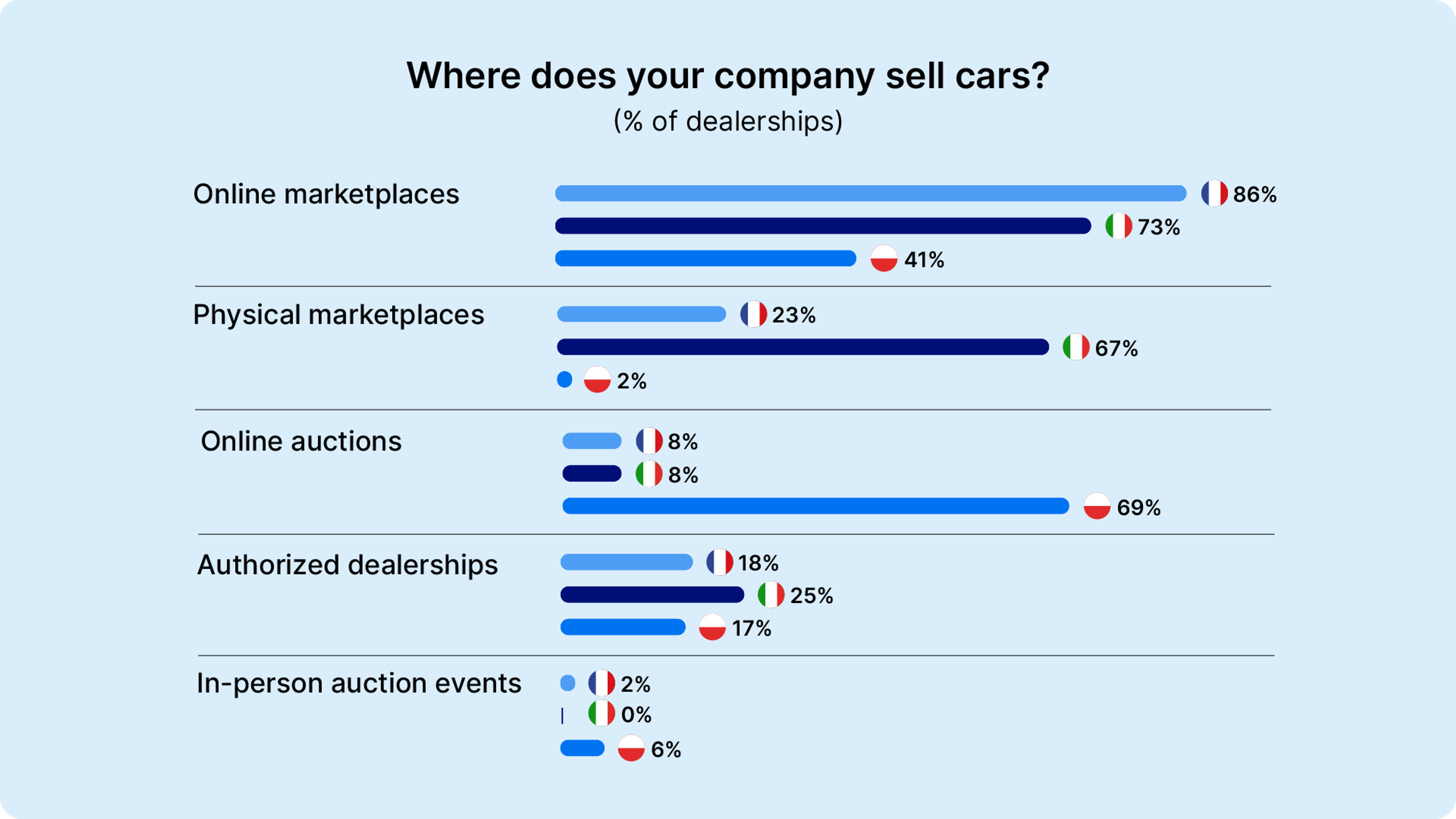

- French dealerships rarely use online auctions to sell cars

- Most Polish (69%) dealerships sell through online auctions

- Most Italian dealerships surveyed sell at least a portion of their cars on physical marketplaces (67%)

- Few French dealerships (23%) and even fewer Polish dealerships sell on physical marketplaces (2%)

- Almost all French dealerships (86%) use online marketplaces to sell some of their cars – this isn’t as much the case in Italy (73%) and Poland (41%)

- Germany is the most common source of cars for all 3 markets, Belgium is second

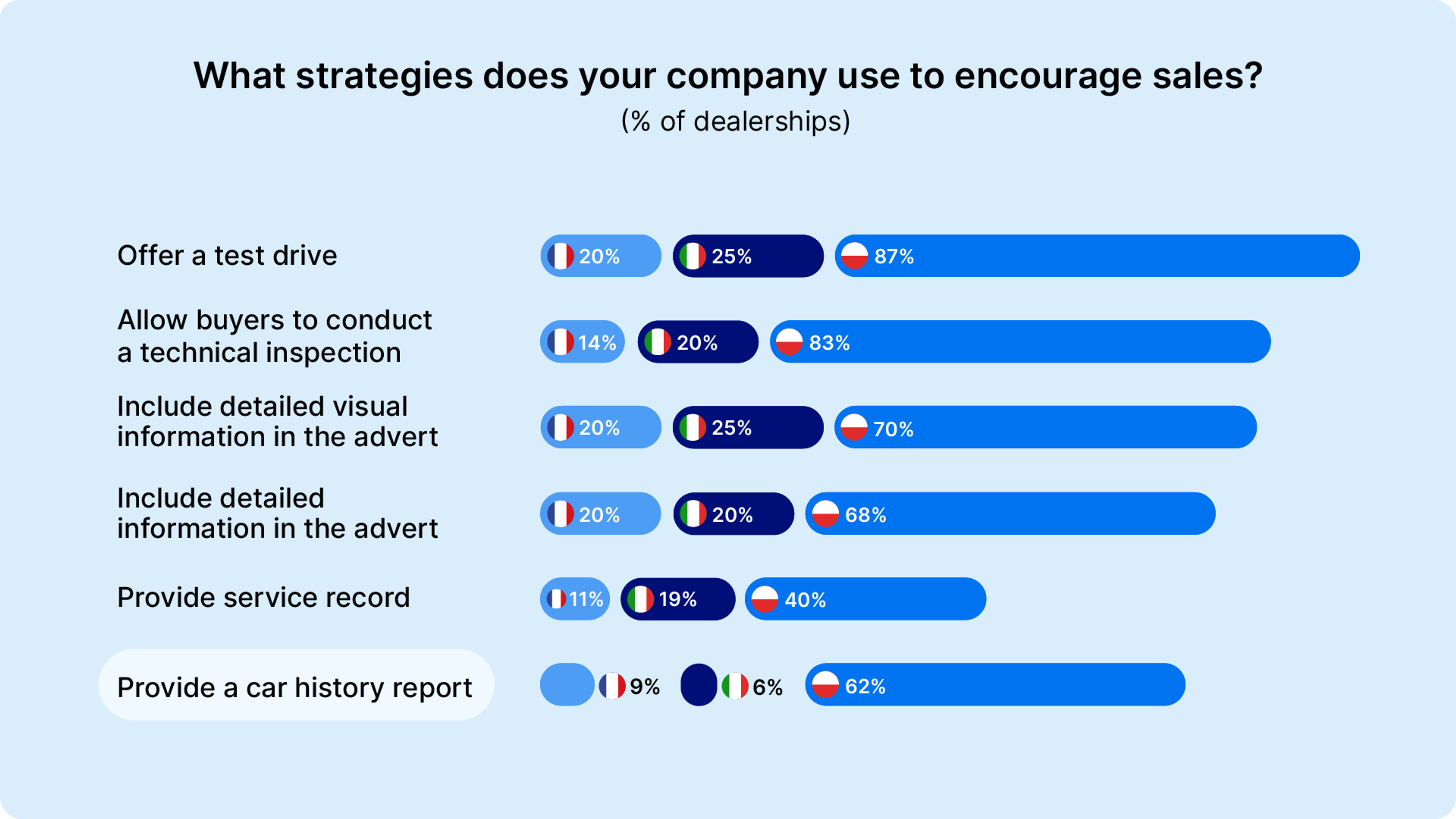

- Polish dealerships offer buyers significantly more information to help sell cars, including test drives, the ability to conduct a technical inspection, detailed information in adverts, and car history reports

- Polish dealerships sell cars the fastest (4.9 weeks avg.), with Italians following (5.3 weeks), and the French being the slowest (5.6 weeks)

Used cars have dark secrets

Reveal them all! Just enter a VIN code and click the button:

Car age, average price, and time to sale: What cars do dealerships sell and how quickly?

The vast majority of cars dealerships sell are either 3-5 years old (50%) or 6-9 years old (33%). Older cars that are 10+ years old only make up 13% of all cars sold. Meanwhile, newer cars (1-2 years old) only make up around 7% of all cars.

The average age of cars sold across the 3 countries is similar: between 5.8-6.3 years.

However, there are significant differences in the average car price. French buyers favor more expensive vehicles (30,000 EUR average) than Polish buyers (21,300 EUR average). Italians, who generally favor smaller cars, tend to buy cheaper – 17,400 EUR average.

Across the 3 countries, more than half of the cars sold by dealerships are in the 10,000-20,000 EUR range. With that said, a significant percentage of buyers (31%) prefer more expensive cars valued between 20,000-50,000 EUR.

Although the difference is small, French dealerships tend to sell the slowest at 5.6 weeks per car. This is understandable given the higher average price. It’s more surprising that Polish dealerships sell faster (4.9 weeks) than Italian dealerships (5.3 weeks), despite the latter dealing in cheaper cars.

Overall, dealerships sell most of their cars (91%) in 1 month (35%), 2-3 months (28%), or 1-3 weeks (28%).

Where do the cars come from?

Dealerships buy cars from various sources, with the most common among the 3 countries being direct purchases from individuals and businesses. However, there are also differences from country to country:

Other authorized dealerships are a significant source of cars from French dealers – almost half (48%) of the surveyed businesses get some of their cars from other dealerships. Relatively few dealers (38%) in France reported buying from online auctions.

These tendencies are different in Poland, where 61% of dealerships buy from online auctions, and Italy (46%). With that said, authorized dealerships are also a significant source of cars for Italian dealerships (41% of businesses) and Poland (albeit less so – 26%).

Online marketplaces are the 3rd most common source of cars for dealerships in France, Italy, and Poland.

When it comes to selling, the French and Italians are again reluctant to use online auctions, whereas they are the most common way to sell for Polish dealerships (69% of businesses).

Instead, French and Italian dealerships rely heavily on online marketplaces (86% and 73% of businesses respectfully). Italian dealerships also favor physical car marketplaces, with 67% of businesses using them for sales.

Biggest foreign markets and their risks

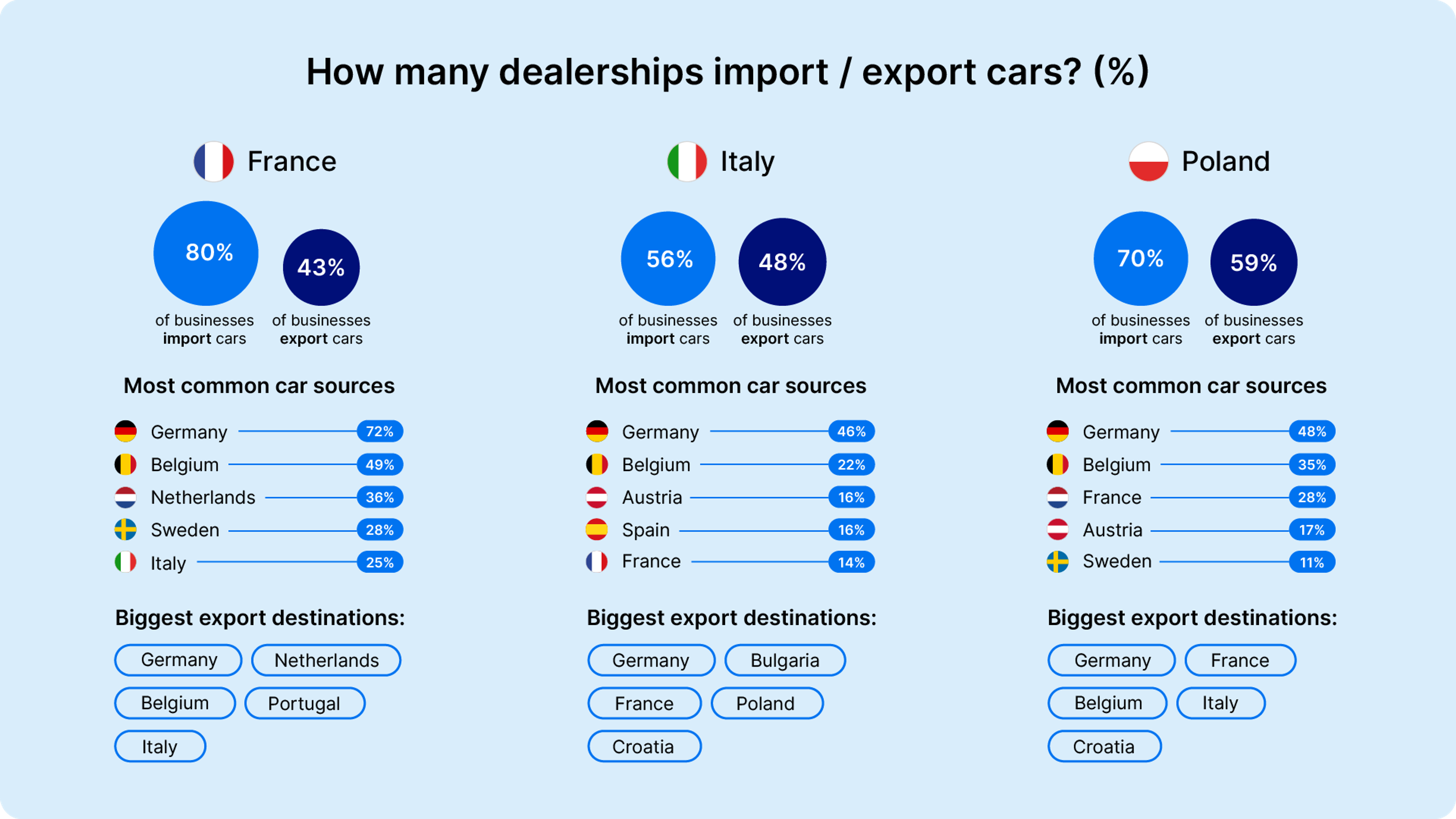

Europe is a huge used car market, so it’s no surprise that many dealerships in France, Italy, and Poland import and export their cars.

80% of French dealerships buy from other countries. The percentage is a little lower in Poland (70%), and Italy (56%).

Fewer dealerships export: 43% of French dealerships, 48% of Italian, and 59% of Polish dealerships.

It’s no surprise that Germany is the biggest exporter to all 3 markets, but somewhat unexpectedly Belgium is the second-most-common exporter:

- France: 72% buying from Germany, 49% from Belgium

- Italy: 46% from Germany, 22% from Belgium

- Poland: 48% from Germany, 35% from Belgium

Among the other popular origins of used cars are the Netherlands, Sweden, Italy, Austria, France, and Spain.

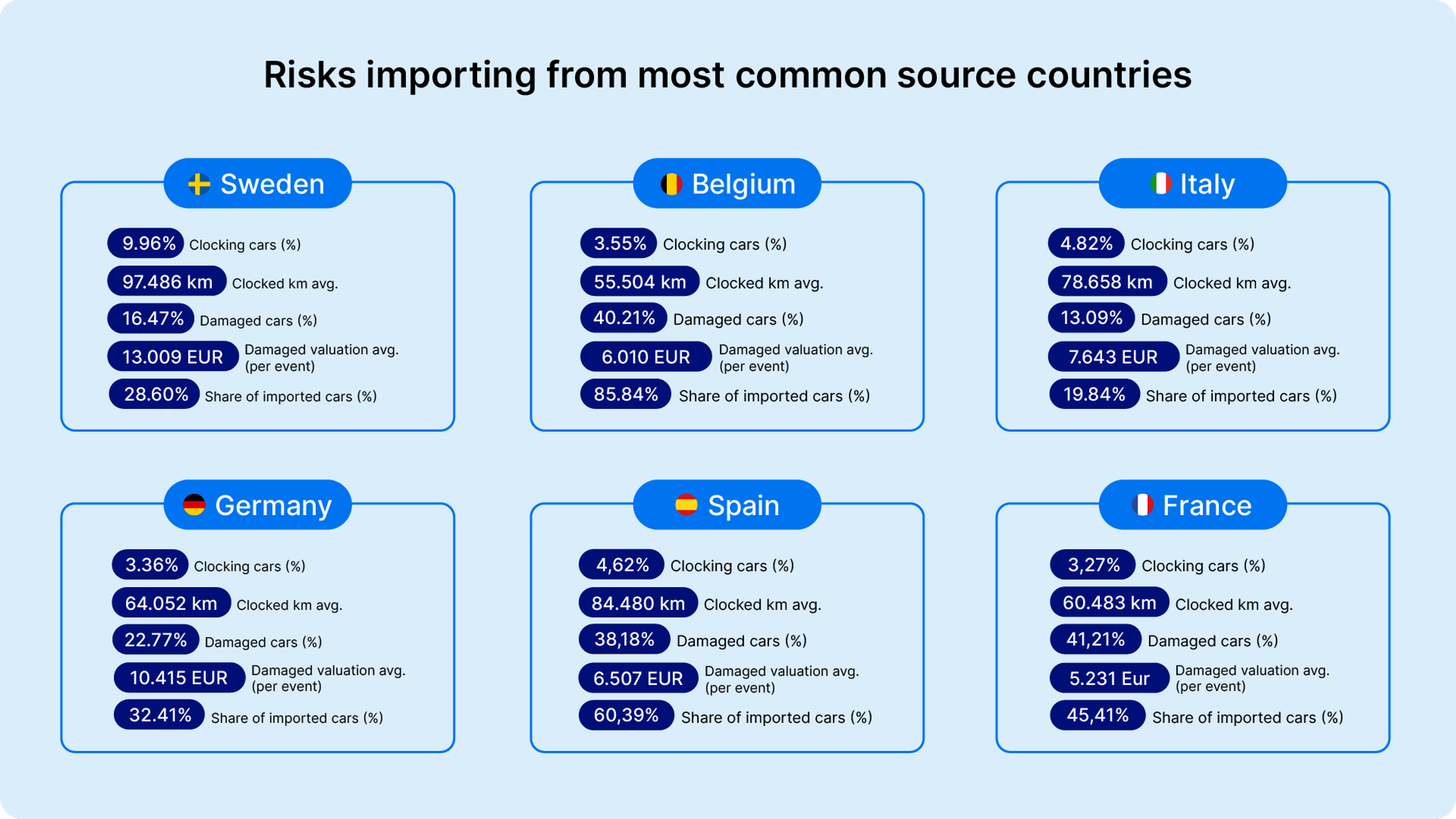

While all these markets are some of the safer ones according to our Transparency Index, there are still significant risks for dealerships. For example, based on carVertical data, 22.77% of cars in Germany are damaged. Meanwhile, a massive 9.96% of Swedish cars have a clocked mileage (at an average of 97,486 km clocked per car).

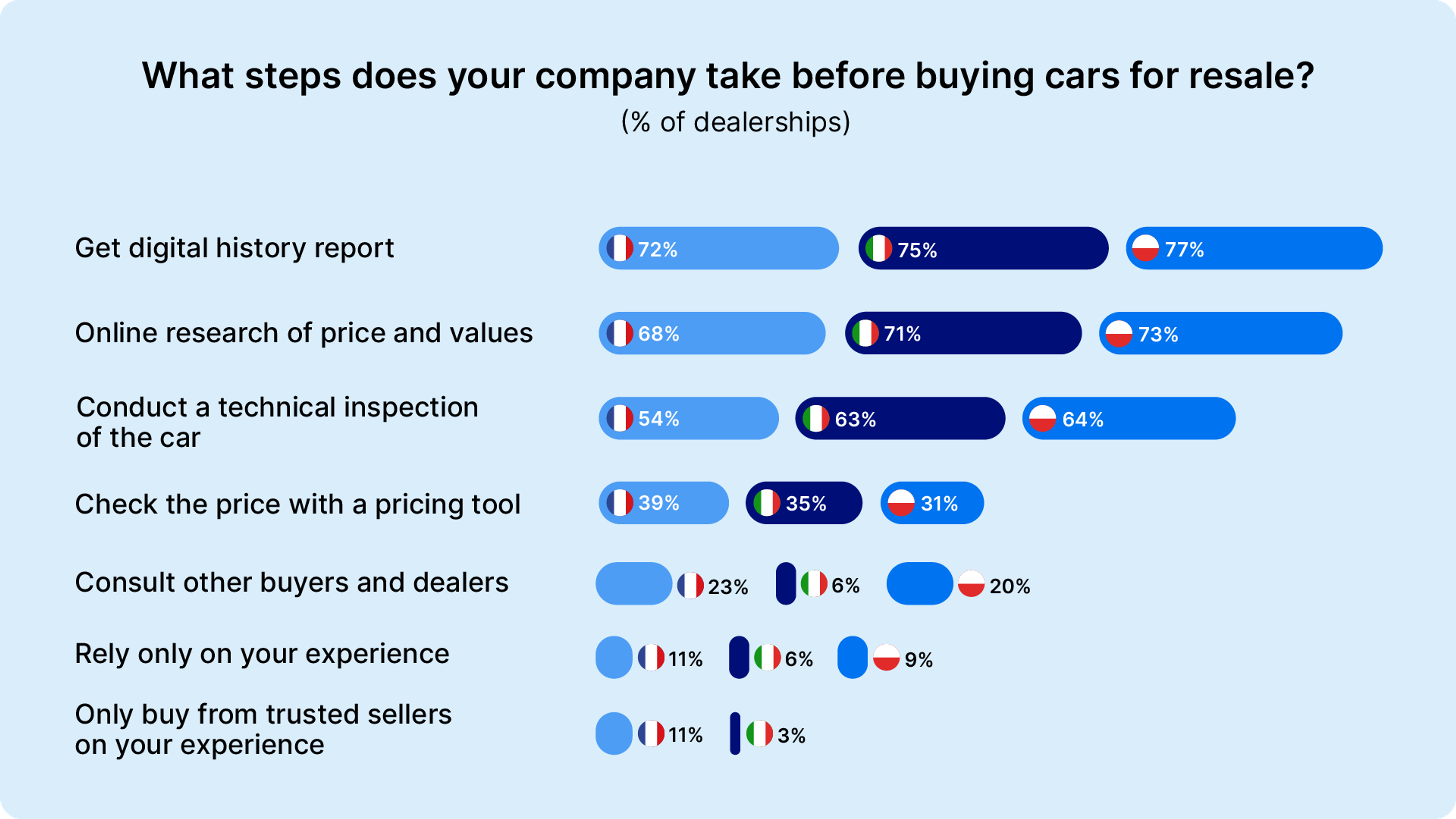

These are all risks dealerships can often avoid with a carVertical vehicle history report. Currently, approximately 7 of 10 dealerships use history checks before buying cars for resale. A larger percentage of Italian dealerships perform technical inspections (a more expensive/time consuming task) than history checks.

Check your VIN

Avoid costly problems by checking a vehicle's history. Get a report instantly!

Germany is also the preferred export destination for dealerships in all 3 countries.

Polish dealerships empower their buyers

As our statistics show, there are significant dangers when buying used cars both for dealerships and their customers. While the risk mitigation methods when buying cars for resale are similar across the board, our research shows a stark contrast in how dealerships in France/Italy and Poland drive sales.

It seems that Polish dealerships offer a lot more information to buyers than their French and Italian counterparts. For example, an overwhelming majority of dealerships in Poland:

- Offer their buyers a test drive (87%)

- Allow buyers to perform a technical inspection (83%)

- Include detailed information (including visual) in their adverts (70%)

- Provide a car history report (62%)

Only a small part of French and Italian dealerships offer any of the above to their customers. For example, only 6% of Italian dealerships provide a car history report to their customers (9% in France).

There are many variables deciding why Polish dealerships sell cars faster (4.9 weeks) than Italian (5.3 weeks) and French (5.6 weeks) dealerships. However, our own analysis shows that giving buyers more information about cars builds trust and helps dealerships sell faster.

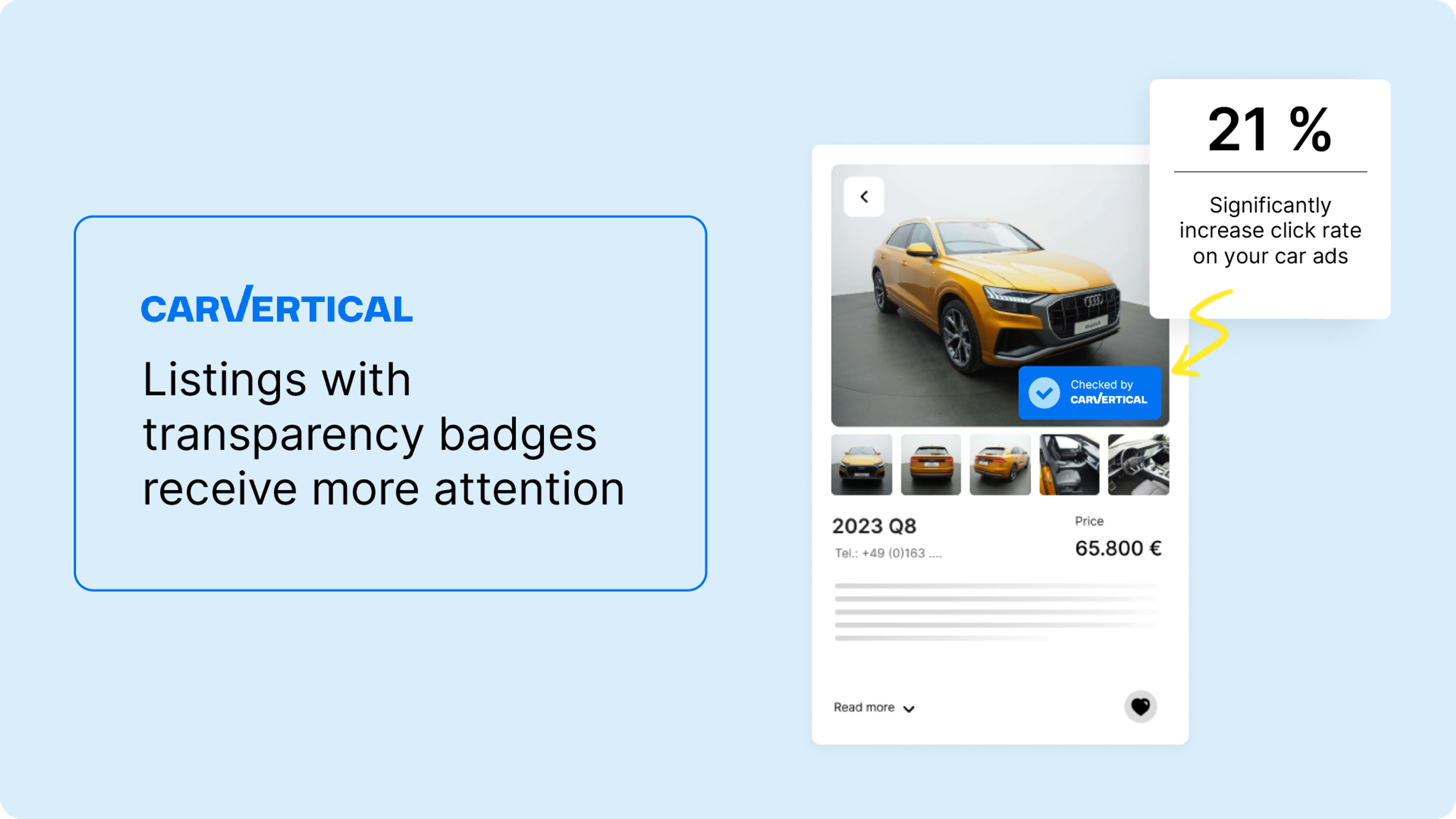

Recently, we ran a practical test with Autojuta, one of the biggest dealerships in Eastern Europe. We had them put up 2 identical ads for the same car, with only 1 difference: one of the ads had a carVertical car history report and Trust badge. The ad with the badge and report got 21% more clicks.

Surprisingly, all 3 countries seem to acknowledge the usefulness of car history reports when buying a car. They’re one of the main risk mitigation tools across the board: 72% French, 63% Italian, 77% Polish dealerships use history reports.